I wish you an informative read and a hopefully early start into spring!

Your

Dirk Schekerka

A lot has happened since the last issue of our Equistone News in October 2020: Five transactions within six months mark a very enterprising half-year for us.

As a joint Munich-, Zurich- and Amsterdam-based team, we were once again able to gain two promising companies with high industry expertise for a partnership with us: In addition to the Dutch precision manufacturing specialist Kusters Beheer B.V., we are also glad to welcome the Swiss kitchen and sanitary fittings manufacturer Franke Water Systems to our portfolio.

In terms of buy & build – often a central pillar of our investment strategy – we have once again been very active alongside our portfolio companies: With no less than three acquisitions – TECO NV, Infraconcepts and tso – the Belgian network equipment supplier Amadys is pushing ahead its internationalisation. Heras, a company specialising in perimeter protection, made its first acquisition with the Danish market leader SER Hegn, and BOAL Group, a greenhouse specialist from the Netherlands, successfully expanded its product portfolio with the family-owned company Alumat Zeeman.

Besides that, in the last few months we have not only succeeded in further expanding our portfolio and supporting our portfolio companies in their individual growth ambitions: With the sale of artisanal meat product specialist Group of Butchers, the long-standing eyewear company Eschenbach Optik and last but not least Oikos Group, a pioneer in the field of future-oriented and sustainable prefabricated house concepts, we placed three of our portfolio companies in the hands of new partners after successful partnerships.

Our newsletter contains further details about the transactions mentioned as well as changes in our teams in Munich, Zurich and Amsterdam.

I wish you an informative read and a hopefully early start into spring!

Your

Dirk Schekerka

In recent years, optical vision aids have developed into a central aspect of individual style. Since its founding in 1913, Eschenbach Holding GmbH (“Eschenbach”) has set new standards in the market for glasses and optical vision aids through new and unique developments in the areas of design, materials and technology as well as through an innovative form-follows-function design philosophy for its products.

More than 100 years after its founding, Eschenbach is today a global market leader for optical vision aids and has established itself as one of the globally leading designers for glasses and optical products. Based in Nuremberg, Germany, the eyewear specialist, which primarily focuses on private labels, is strongly positioned in the Western European market and has a strong sales network in the USA.

With its products, Eschenbach combines function with award-winning design and highest quality standards, as shown by the three “Red Dot Awards”, prestigious design awards the company received for its product designs three years in a row in recent years. With its broad product portfolio – from distinctive eyewear brands to magnifying vision aids and binoculars – Eschenbach addresses an international customer base and has since late 2019 also become leading on the German market for eyewear frames across all price segments, according to Gesellschaft für Konsumforschung (GfK), the largest German market research institute.

In July 2007, Equistone along with the Eschenbach management team had acquired the company from the founding family and a financial investor. Since then, we have continuously driven Eschenbach’s growth potential and expanded its strong market position: Through important strategic acquisitions such as the British eyewear business International Eyewear Limited (2008) and the US-based eyewear brand Tura (2009), we have advanced the company’s internationalisation plans, in particular in the core markets of Europe and the United States. In addition, we also managed to increase Eschenbach’s revenues to EUR 143 million in 2019 and staff size to 570 through a realignment of its business model as well as a modernisation of its product range.

Together with its new owner, Inspecs Group, based in Bath in the UK, the German company will once more strengthen its global market position in the long term. The five-year growth strategy developed jointly by our team and Eschenbach will be the ideal foundation to do so and continue the company’s success story of recent years in the future as well.

Global meat consumption has significantly increased in the previous five years, which has consequently also increased the importance of aspects such as humane treatment of animals as well as quality and sustainability standards. With its innovative products and a passion for their trade, Group of Butchers, based in the Netherlands, represents the future of sustainable artisanal meat products.

Founded in 1997 in Tilburg in the Netherlands, Group of Butchers has developed into a market leader for high-quality artisanal meat products with a focus on sausage and minced meat specialties in its home market. Due to the group’s high quality standards, intelligent product marketing as well as its broad expertise and keen eye in spotting new trends in the premium meat products segment, it has an excellent market position. Long-standing customer relations with leading retail chains – in particular in its core markets in the Netherlands, Belgium and Germany – have enabled the group to build a strong network of sales partners.

As part of the group’s growth plans, Equistone had acquired a majority stake in Group of Butchers in January 2017 and decisively supported a successful buy-&-build strategy since then. In recent years, we have leveraged targeted acquisitions and market expansions to continuously drive the organic and inorganic growth of the group. Several acquisitions, such as Koetsier Vleeswaren and Keulen Vleeswaren, two Dutch producers of smoked and cured sausage products, as well as Hartmann GmbH, a German producer of minced meat products, enabled us to significantly strengthen the group’s position in the Netherlands and increasingly in Belgium and Germany as well, and expand its geographic reach.

Today, Group of Butchers employs a staff of 900 at 12 production sites and two distribution centers. Together with the new owner Parcom, the group will lay the foundation for its next growth steps.

A well-functioning and reliable utility infrastructure forms the basis for our everyday life and especially in extraordinary circumstances such as the current coronavirus crisis, its importance to ensure basic utilities becomes clear once more. With its solutions in the area of passive network components, Amadys is making an important contribution to this.

With about 20 years of experience, Amadys has developed into a leading provider of passive network component solutions for utility infrastructures in the Benelux region. The company, being part of the Equistone Partners Europe portfolio since late 2019, is especially active in its core markets Belgium and the Netherlands as an important partner for leading utilities and industrial companies. With the highest degree of product expertise and service quality, the network equipment provider offers its longstanding customers from the telecommunications, water, gas, electricity and industrial sectors a diversified product portfolio which can be tailored specifically to a customer’s requirements, from optic fibre cabling and components to ducts, closures and covers. Due to its strong sales partnerships with OEMs, which Amadys has built up over the years, the company is able to provide products and services along with broad technical expertise from one source.

With the recently completed acquisitions of the companies Infraconcepts, tso and TECO, Amadys realised important milestones of its growth strategy: Since December 2020, Infraconcepts, a specialist for passive network components based in the Netherlands, is further strengthening the product and service portfolio of Amadys. Infraconcepts holds a strong position in the telecommunications market and has significantly contributed to the country’s broadband expansion. Together with Amadys, the market position is to be strengthened further and additional growth potential in the Benelux region is to be leveraged.

The acquisition of tso, a provider of splicing and measurement technology, equipment and devices for fibre optic communications networks based in the German state of North Rhine-Westphalia, marks an important step of Amadys’ expansion strategy: With this acquisition, which has been completed in February 2021, Amadys could establish its first presence in the promising German market for fibre optic communications infrastructure. With the support of Amadys, tso’s product and service portfolio are set to be broadened and tso is to be established as a full-service partner for telecommunications customers in the DACH region.

The third acquisition for Amadys was successfully completed in March 2021: TECO, a manufacturer of electrical smart meter cabinets and fuse boxes for the Belgian electricity market joins the group to further complement the product portfolio of Amadys. Headquartered in Dendermonde in Belgium, TECO develops and produces plastic moulded products for the electricity segment and performs some light assembly works. This will allow Amadys to provide a larger product portfolio to its existing customer base and further strengthen its position as a one-stop-shop provider.

The focus of all three acquisitions is the internationalisation of the business model together with the expansion of the product and service portfolio of Amadys to further strengthen its excellent market position as a full-service partner for both the Benelux and the DACH region.

Protection from threats and the guarantee of security – both in the private and public sectors – occupy a central place in our everyday lives. Since its foundation in 1952, Heras, headquartered in Oirschot in the Netherlands, has specialised in comprehensive solutions to ensure these important aspects.

With its broad product portfolio of mobile and permanent perimeter protection systems and products, Heras, with its total of around 1,100 employees, has developed into a player operating throughout Europe: Especially for the construction, public authorities and trade sectors the specialist for safety and security products, systems and services offers individual solutions tailored to the needs of its customers. In particular, Heras’ mobile fencing systems, vehicle barriers and manually operated as well as automated gates are used for securing construction sites and large events. The company’s permanent perimeter protection solutions in the medium- and high-security range are used in a wide variety of areas, for example to protect critical infrastructure such as data and logistics centres, airports and power plants, in border control, but also at a more local level, protecting schools, kindergartens and hospitals.

Due to its strong network of production sites across Europe, long-standing customer relationships and experienced management, Heras has built up an excellent market position. The acquisition of SER Hegn, based in Denmark, marks the first purchase for our portfolio company since acquiring our majority stake in September 2019 and thus contributes to the successful realisation of the joint consolidation strategy: With more than 30 years of experience, SER Hegn is the market leader in sales, installation and maintenance of perimeter protection systems in Denmark and also a long-standing partner of Heras. Together, synergies in sales, purchasing, products and logistics are to be realised in the future. In addition, SER Hegn's strong regional network and customer orientation will drive the expansion of Heras' market presence in the Nordics.

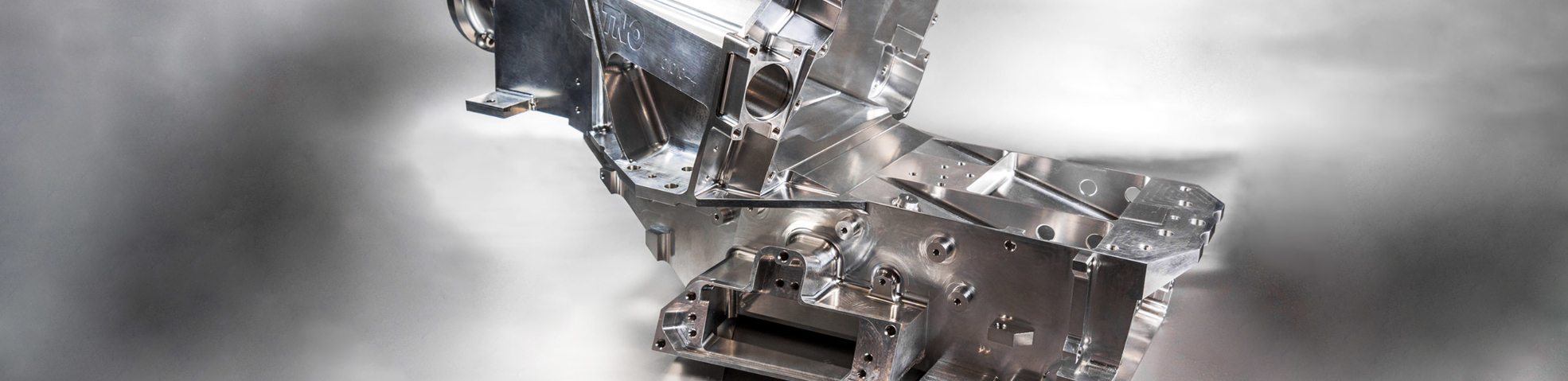

The rapid growth of the technology sector – particularly in the areas of electronic applications and precision components – has continued despite extraordinary circumstances caused by the coronavirus pandemic. With a market-leading position in this sector, our new portfolio company Kusters Beheer B.V. has established itself as an internationally active player in the field of mechanical high-tech precision components.

Kusters Beheer, based in Oss in the Netherlands, consists of six companies – Kusters Precision Parts, Wilting, HFI, Jatec, Visietech Technical Products and TB Precision Parts – which together form a leading producer of mechanical high-tech precision components under the joint umbrella brand. Founded in 1973, Kusters Beheer has an excellent market position due to broad technical and specialised process expertise as well as a strong production network in the Netherlands, particularly in the high-tech region around Eindhoven. With a total staff of 300 across the group as well as state-of-the-art machining and (clean room) assembly facilities, the group produces for an international customer base, particularly in the semiconductor as well as aerospace, automotive, packaging, food and medical industries.

For the Equistone team, the acquisition of the high-tech precision component specialist in January 2021 marks another important step in strengthening Equistone’s presence in the Benelux region: In addition to advancing Kusters Beheer’s organic and inorganic growth, further consolidation of the group’s individual companies as well as accessing new customers and expanding into neighbouring markets will be the focus of the new partnership.

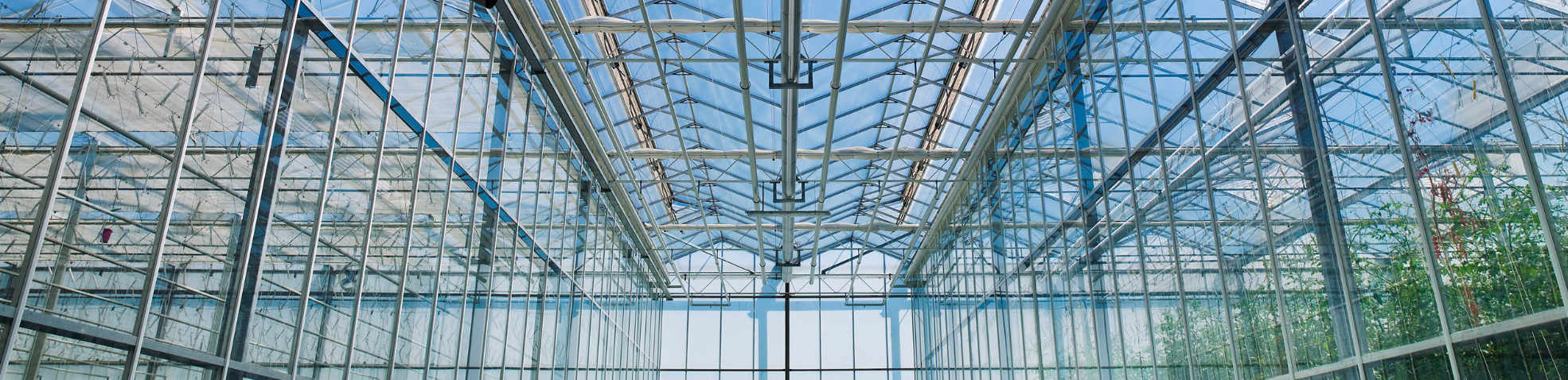

A healthy and balanced diet plays an important role in today’s society – regardless of the current season. Accordingly, the year-round availability of seasonal fruits and vegetables is central to our societal wellbeing and one of the great achievements of modern agriculture, only made possible through the use of state-of-the-art greenhouses with the appropriate technical equipment. One of the leading providers of such technology is BOAL Group, based in Naaldwijk in the Netherlands, which specialises in the production of aluminium roofing and sidewall systems for industrial greenhouses.

Since our investment in April 2018, the greenhouse specialist has successfully driven the continuous expansion of its already strong market position and has managed to expand its presence as well – particularly in the Benelux region – through both organic growth and targeted acquisitions.

With the acquisition of Alumat Zeeman in January 2021, we continue to advance the growth strategy of our portfolio company along with the BOAL management team: The family-owned specialist for greenhouse technology offers its customers an extensive and innovative selection of products and solutions, ranging from greenhouse components to parts for ventilation mechanisms and screening installations, or complete systems for the international agricultural and horticultural sector. With the integration of this range of products, BOAL expands its current product portfolio for its steadily growing international customer base, while at the same time further strengthening its market presence in the Benelux region.

When it comes to equipping private living as well as public spaces, highest standards of quality and innovative design concepts are central decision-making factors. As a former part of a well-established Swiss company, our new portfolio company Franke Water Systems has been a pioneer in the areas of kitchen and sanitary fittings in the European market for a long time.

Franke Water Systems has been an independent division of Franke Gruppe, founded in Rorschach, Switzerland, in 1911. Due to its innovative and intelligent bathroom and sanitary solutions for residential, public and commercial sectors, the company has established itself as a globally leading supplier of complete sanitary systems. Consisting of two business units – KWC Group (“KWC”) and WS Commercial Group (“WSC”), Franke Water Systems unites two excellently positioned brands, which combine highest quality and functionality with innovative design in their product range.

The well-established company KWC is a Swiss market leader for residential bathroom, residential kitchen and commercial kitchen fittings and provides its customers with solutions ranging from the mid- to luxury price segment. The high-quality stainless-steel fittings and components of WSC address the commercial and (semi-)public bathroom sectors in particular. They are primarily used in washrooms of public facilities such as office or administrative buildings, sports stadiums as well as hotels and hospitals.

Due to the Swiss specialist’s multi-brand strategy, it has productions sites and competence centres in Europe, the United Arab Emirates and Asia. In 2020, Franke Water Systems employed a staff of around 900 and generated revenues of more than 192 million Swiss Francs.

With the acquisition of our recent majority stake in Franke Water Systems in March 2021, we support the carve-out from the parent company and expand our already strong presence further. Together with our co-investor Thorsten Klapproth, former CEO of Hansgrohe SE and WMF AG, as well as the current management team, we aim to further advance the international expansion as well as support the organic and inorganic growth of Franke Water Systems, with a particular focus on developing its innovative product range and strengthening its excellent brand positioning further.

Future-oriented concepts for living spaces need to be both sustainable and cost-efficient. However, at the same time, they also need to be unique and attractive to appeal to potential residents. Oikos Group, a leading provider of prefabricated houses for the European market, based in Schlüchtern, Germany, knows of these requirements and as one of the pioneers in this area has specialised in meeting them with innovative design as well as the highest quality and sustainability standards.

In the European market, Oikos Group with its three brands Bien-Zenker, Hanse Haus and Living Haus, is one of the leading B2C providers of single- and two-family houses. The company offers its customers innovative and tailored concepts for living spaces, from shell construction to turnkey-ready homes. In its core markets of Germany, Austria, Switzerland and the UK, Oikos Group employs a staff of around 1,300 and has managed to increase its revenues to more than EUR 400 million in 2020.

Funds advised by Equistone acquired Oikos Group in early 2018. With Equistone’s support, the group has managed to further accelerate its growth strategy and implement a range of measures to increase its level of digitalisation and operational excellence. In particular, the areas of sales and digital customer journey, could be leveraged in this way to generate additional growth. Furthermore, a best practice approach between the group companies has been established to further increase efficiency and to optimise processes.

As a result of the excellent development of Oikos Group in recent years, funds advised by Equistone sold Oikos Group in March 2021 to West Street Capital Partners VIII, a fund managed by Goldmann Sachs. Together with the new partner, Oikos Group will continue its growth strategy.

Hubert van Wolfswinkel has been promoted to Partner of Equistone Partners Europe as of March 2021. Since the beginning of 2019 he has been strengthening the DACH/NL team from our office in Amsterdam and is responsible for managing our investments in the Benelux region in particular. Before joining Equistone as a Director, Hubert worked for the investment firm Montagu Private Equity in London and Amsterdam. He started his career at Bain Capital Private Equity and McKinsey & Company.

As of March 2021, David Zahnd has been promoted to Director at Equistone Partners Europe. For the past six years and together with his colleagues from our office in Zurich, David has been responsible for the project management and execution of our Swiss private equity transactions. Prior to joining Equistone, he gained extensive investment experience at Gilde Buy Out Partners, among others. David Zahnd holds a Master's degree in Banking & Finance from the University of St. Gallen.

Maximilian Göppert has also been promoted to Director at Equistone as of March 2021. Before joining the Munich team of Equistone Partners Europe in 2013, he worked in the private equity division at Partners Group in Zug, Switzerland. Previously, he gained extensive professional expertise at Bain & Company, Berenberg Investment Banking and Unilever. Maximilian holds a Bachelor's degree in Business Administration and Entrepreneurship from the University of St. Gallen and a degree in Management from the University of Singapore.

Moritz Treude, part of the team of Equistone Partners Europe since 2017, has been promoted to Investment Director as of March 2021. Before joining Equistone, Moritz worked for Boston Consulting Group in Zurich for several years as a management consultant with a focus on the industrial goods sector. Prior to that, he gained professional experience in the management of his family's retail business, as well as at DAW and Procter & Gamble, among others. Moritz graduated from the University of St. Gallen with additional terms spent at the Stockholm School of Economics and the Manchester Business School.

As of March 2021, Roman E. Hegglin was promoted to Investment Director. Since 2016, he has been responsible for the project management and execution of our Swiss private equity investments together with his colleagues from the Zurich office. Prior to joining Equistone, he worked as an Associate at Credit Suisse in investment banking, specifically in the areas of M&A and Capital Markets. Prior to that, he gained professional experience at UBS Investment Bank and Helbling Corporate Finance, among others. Roman holds a Master's degree in Accounting & Finance and a Bachelor's degree in Business Administration from the University of St. Gallen.

Tanja Berg has been promoted from Investment Manager to Investment Director as of March 2021. In her new position, she is responsible for our investment activities in the entire DACH and Benelux regions from our Munich office. Before joining Equistone Partners Europe in 2016, she gained extensive industry expertise in various positions at goetzpartners, Bilfinger SE as well as UniCredit and in the private equity business of Deutsche Beteiligungs AG. Tanja holds a Master’s degree in Management from the University of Mannheim and a Bachelor’s degree in Business Administration from the Duale Hochschule Mannheim.

Philipp Gauss, who has been part of our Munich team since 2019, was promoted to Investment Manager as of March 2021. Before his time at Equistone he worked as a project manager for the strategy consulting firm Stern Stewart in Munich, where he advised clients from the industrial goods, energy and media sectors on transactions and restructurings. Philipp holds a Master's degree in Management from the University of Mannheim and a Bachelor's degree in Business Administration from the EBS University of Economics and Law in Oestrich-Winkel.

The past few months have definitely been associated with some major challenges. But this period has also proven once again how important it is to support each other as a team. The colleagues have really done an outstanding job in the past months – and we would like to show our appreciation for this with their promotions.