Equistone Partners Europe sells The Mill in a transaction valued at £190m

Funds managed by Equistone Partners Europe (“Equistone”) have sold their majority shareholding in The Mill via a trade sale to Technicolor.

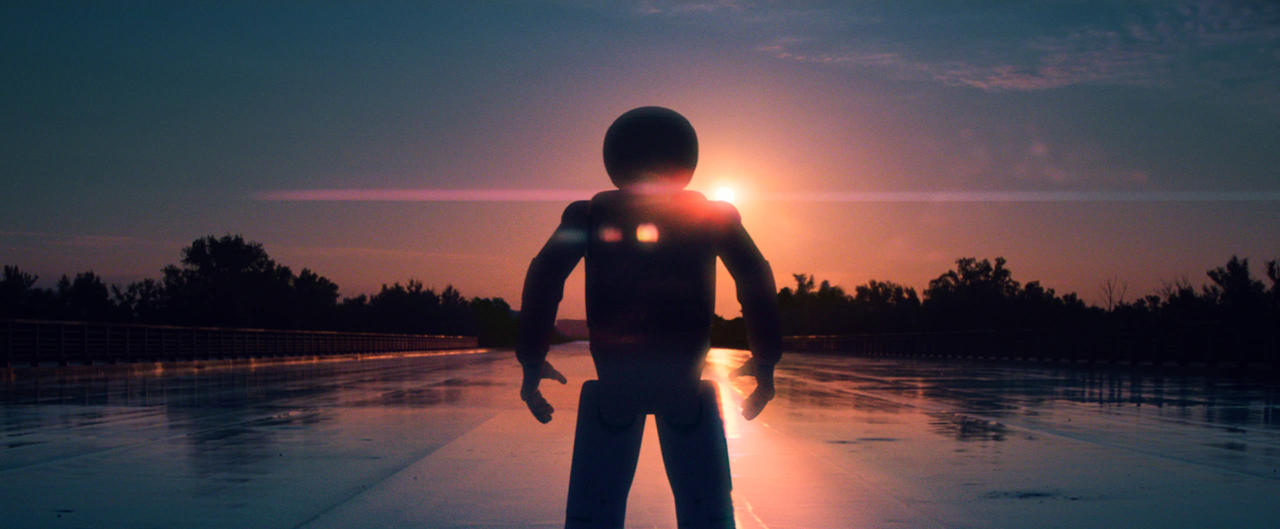

Founded in 1990 in London, The Mill is recognised by its clients and peers around the globe as the premier provider of moving image visual content across all media. The Mill works with advertising agencies, brands and production companies to create premium content for all channels and platforms and has helped create some of the most iconic advertising around the world for brands such as Nike, Coca Cola and Guinness.

With over 800 employees across its studios in London, New York, Los Angeles and Chicago, The Mill now counts the world’s top brands, directors and advertising agencies amongst its clients. The business is also one of most awarded firms in its field through its consistent successes at industry awards, most notably winning Five Lions at the Cannes Festival of Creativity in 2015.

Equistone acquired a majority stake in The Mill in April 2011, backing the founders and senior team in a management buy-out. Since then the business has expanded geographically and broadened its offering to clients, demonstrating a strong growth trajectory with revenues increasing from £86m in 2011 to £110m in 2014 and being highly cash generative.

The investment was made from Equistone’s Fund III and has generated a return in excess of 2.0x its investment.

Commenting on the transaction, Steven Silvester of Equistone said: “The Mill has never ceased to impress us with its consistent ability to generate incredible visual content for the world’s top brands. The team at The Mill has the rare mix of skills required to harness and nurture the very best creative talent whilst successfully running and growing a successful and flagship enterprise.”

Robin Shenfield, CEO of The Mill commented: “We have hugely enjoyed our partnership with Equistone over the last four and a half years. Their support has enabled us to continue to expand our global reach and offering to help our clients create the most engaging and creative visual content across the rapidly changing technology landscape. We look forward to joining Technicolor, a company which has huge pedigree in the world of the moving image.”

For Equistone, the transaction was led by Steven Silvester, Sam Breuning. Equistone was advised by Harris Williams (M&A), Travers Smith (Legal) and PriceWaterhouseCoopers (Financial) and Deloitte (Tax).

Pressekontakt

DEUTSCHLAND / SCHWEIZ / NIEDERLANDE

München, Zürich, Amsterdam

- IWK Communication Partner

- Ira Wülfing / Florian Bergmann

- Tel: +49 (0)89 2000 30 30

- E-Mail IWK

FRANKREICH

Paris

- Brunswick

- Agnès Catineau/Aurélia de Lapeyrouse

- Tel: +33 (0)1 53 96 83 83

- E-Mail Brunswick

UK

London

- Hawthorn Advisors

- James Davey / Daniel Thomas / Stephen Atkinson

- Tel: +44 (0)20 3745 4960

- E-Mail James Davey

- E-Mail Daniel Thomas

- E-Mail Stephen Atkinson

Birmingham

- MC2

- Amy Cantrill / Emma Gage

- Tel: +44 (0)161 236 1352

- E-Mail Amy Cantrill

- E-Mail Emma Gage

Manchester

- MC2

- Liam Buckley

- Tel: +44 (0)161 236 1352

- E-Mail Liam Buckley