We hope you enjoy reading this issue of Equistone News and wish you and your colleagues and families good health and confidence for the coming weeks.

Best Regards

Dirk Schekerka

Within just a short period of time, our world has been turned upside down by COVID-19. The resulting uncertainty in regard to the further developments of the situation and its economic consequences are on the minds of us all. At Equistone, we are working together with our portfolio companies more closely than ever to optimally support them during the current situation.

What this crisis has clearly shown:

For perhaps the first time, the integration of global markets has become a serious risk. Nonetheless, we are convinced that investments in stable, economically resilient companies will continue to be the right choice in this environment as well; they have also always been a cornerstone of Equistone’s philosophy and sustained, previous success.

All our efforts are focused on making sure that our portfolio companies can continue to optimally respond to changing markets, customer behaviours, technologies and business models and continue their development. In recent months, our DACH/NL team has completed the acquisition of three promising companies, each with a very high level of industry expertise: the Dutch perimeter protection specialist Heras, the pharmaceutical wholesaler Omnicare and Amadys, a provider of passive network equipment solutions and our first Belgian acquisition.

In terms of Buy-&-Build – often a central element of our investment strategy and a major component of value protection and generation, particularly in uncertain environments, we have once again been very active alongside our portfolio companies. The greenhouse specialist BOAL Group has acquired the company Holland Group Westland and the online marketing specialist PIA has acquired both the creative agency Nordpol+ and the mobile performance company DCypher. RENA Technologies is expanding its business with the acquisition of the US company MEI, a supplier of wet chemical processing systems, and United Initiators is strengthening its presence in the Canadian market for hydrogen peroxide through the acquisition of PeroxyChem Canada.

Our newsletter contains further details about these new investments and acquisitions as well as a case study of RENA and news about the current successes of our portfolio company Eschenbach Optik and changes in our team. We also have several employees who have been with us for a long time and we are delighted to be celebrating their company anniversaries.

We hope you enjoy reading this issue of Equistone News and wish you and your colleagues and families good health and confidence for the coming weeks.

Personal security, asset protection and the security of sensitive infrastructure play an important part in our everyday lives. The company Heras, founded in 1952 and headquartered in Oirschot in the Netherlands, specialises in solutions for the protection of these sensitive areas. With its wide portfolio of mobile and permanent perimeter protection systems and products, the company has developed into the leading player in Europe, with its outstanding market position being based on a strong network of production sites, longstanding customer relationships and experienced management team.

Among Heras’ main customers for its mobile solutions are construction companies, public authorities and event organisers. Its fencing systems, electronic perimeter detection systems, hostile vehicle mitigation barriers and manual and automated gates for this segment are used primarily to secure construction sites and major events. The medium- to high-security permanent solutions are used in a variety of applications, such as border control, and for the protection of military bases and critical infrastructure such as data centres and power stations, as well as around schools and nurseries.

We acquired a majority stake in Heras from the building materials company CRH plc based in Dublin, Ireland, as part of a carve-out. The deal was signed in July 2019 and closed in September of the same year. At the time of acquisition, Heras employed over 1,100 staff and had an annual turnover of around 226 million euros. Our stake in the company will enable us to accompany it on its future growth journey and during its expansion into new markets. The development of new products and services, the establishment of additional customer relationships and the expansion of existing networks will be key to strengthening organic growth.

The treatment of patients, especially in the field of oncology, is an important challenge that requires care and professionalism at all levels. With its awareness of this and exceptional quality standards, Omnicare is a key player in the German healthcare market.

The company was founded in 2002 and specialises in the distribution of finished medicinal products to pharmacies for the production of patient-specific cancer drugs. Since 2012, Omnicare has also developed a wide portfolio of additional services, thus enabling it to help improve the local treatment of cancer patients in Germany. The Bavaria-based company now also supports highly specialised pharmacies and medical practices in quality assurance, cleanroom hygiene monitoring and in the training and development of specialist staff.

Through initiatives such as the Omnicare Quality Initiative, which aims to ensure the safe and high-quality care of cancer patients, and the creation of the German Oncology Network, Omnicare is actively involved in the structural development of the healthcare sector throughout Germany.

Having completed the transaction to acquire a majority stake in Omnicare from the shareholder consortium in October 2019, we aim to work closely with the company and develop its strong market position sustainably for the long term. As new majority shareholder, we will continue to support the development of the company and support its significant contributions towards ensuring the supply of high-quality and affordable treatment options for cancer patients.

A well-functioning and reliable supply infrastructure is not only essential to everyday life, but also has a major effect on our quality of life, whether in fast-growing cities or in smaller communities. Our new portfolio company Amadys plays a key role in this area as a provider of passive network equipment solutions.

Amadys mainly serves the core markets in Belgium and the Netherlands, where it has established a strong market position thanks to its high level of product expertise and service quality. With around 20 years of experience, Amadys is an important partner to leading utility and industrial players in the Benelux region and provides its longstanding customers with a diverse product portfolio, particularly in the areas of telecommunications, water, gas, electricity and industry, ranging from fibre optic cabling to ducts, closures and covers, often developed for and adapted to specific customer requirements. The company also has a number of strong distribution partnerships with OEMs and can therefore offer products and services as well as extensive technical expertise from a single source.

Amadys is the Equistone team’s first investment in Belgium. Having completed the acquisition in December 2019, we aim to work together with the company’s management team to further support its organic and inorganic growth trajectory. Our focus is on driving the internationalisation of the business model and further consolidating the market, with the specific aim of promoting Amadys’ outstanding market presence in the Benelux markets and beyond.

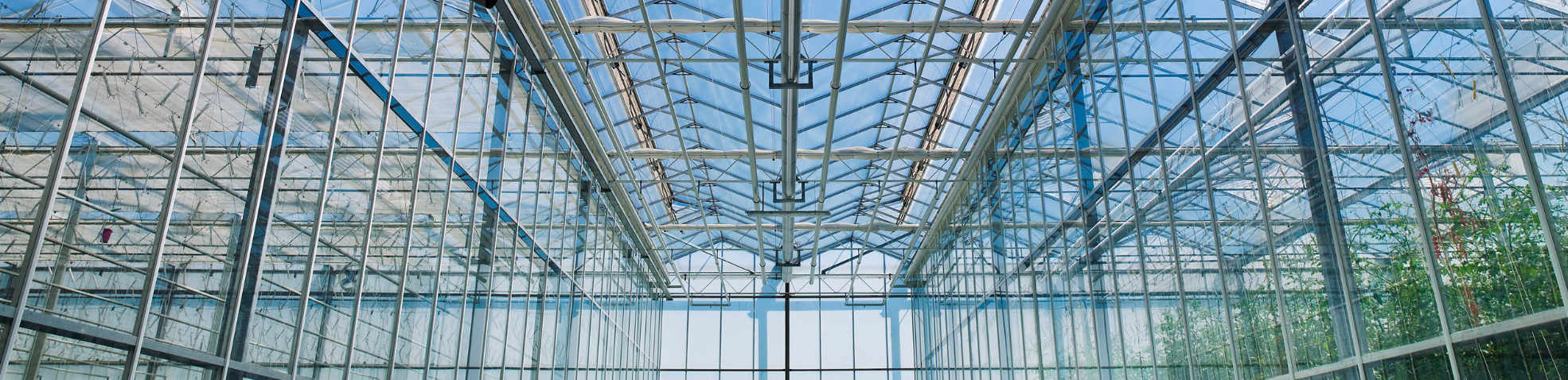

Cucumbers, tomatoes, strawberries and rhubarb – even in winter. The year-round availability of seasonal fruit and vegetables is one of the great achievements of modern agriculture. It is only made possible by the use of state-of-the-art greenhouses and requisite technical equipment. One of the leading providers of these technologies is BOAL Group, headquartered in Naaldwijk in the Netherlands, which specialises primarily in the production of aluminium roof and side-wall systems for glass and poly greenhouses. Since our initial acquisition of a stake in BOAL Group in April 2018, the company has consolidated its already strong market position through both organic growth and targeted acquisitions.

In June 2019, it acquired West.Neder.Land (WNL), a supplier of sandwich panels for logistics and storage areas in poly greenhouses, followed in September 2019 by the acquisition of Holland Group Westland, which is headquartered in Maasdijk in the heart of the farming region of Westland. Holland Group Westland is among the market leaders in the design, production and installation of screen systems, which enable the efficient and energy-saving control and regulation of heat, humidity and sunlight in greenhouses. Holland Group Westland also provides multiple effective insect netting solutions as part of an environmentally friendly integrated pest management strategy. The acquisition of Holland Group Westland enables BOAL to offer its customers an even wider range of products and services for greenhouse management and to become an integrated provider for the greenhouse industry.

Creativity in the production of content and in the use of innovative and flexible, scalable software solutions are two of the key pillars of successful digital marketing. With this in mind, our ever-expanding portfolio company Performance Interactive Alliance (PIA) is bringing on board significant additional expertise with the acquisitions of a software platform for mobile tracking and programmatic media buying, as well as of a renowned creative agency.

PIA Group was formed in April 2014 following the merger of four large German online marketing companies under the aegis of Equistone. Performance Media, Blue Summit Media, Econda and Delasocial had previously cooperated on different projects and had established an excellent reputation in the industry as well as a rapidly growing client base. Equistone’s investment meant that the skills of the individual companies in the areas of digital marketing and advertising, social media monitoring, web analysis, search engine optimisation and search engine advertising could be combined and made available from a single source. Subsequent acquisitions consolidated the service offering.

As recently as November 2019, TAB GmbH – a specialist in mobile performance marketing and part of the PIA Group since September 2018 – strengthened its portfolio with the acquisition of the software platform of DCypher Media B.V., thus expanding its own profile with a flexible in-house solution. With this new service portfolio, which includes managed performance marketing campaigns, programmatic media buying, social and search advertising as well as Direct Drive – its own Advertising Self-Serve Platform (ASSP) – TAB GmbH, which will in the future operate as "Qverse", offers its clients a wide range of individual and transparent campaign solutions for mobile brands.

In January 2020, PIA Group then added extra creative edge with the acquisition of Nordpol+, a creative boutique agency, which since its founding in 1998 has been providing excellent global and cross-channel communication, video and design services for brands such as Renault, Dacia and IKEA. Together with Nordpol+, PIA Group now comprises twelve specialist companies and is in an excellent position to improve the efficiency and effectiveness of all of its clients‘ digital sales and marketing activities in the long term, courtesy of best-of-breed offers and tailor-made solutions in the areas of content, media and data.

As the second-largest country in the world, Canada is a rich and diverse source of wood, with around 40 percent of the country covered in forest. British Columbia is at the heart of the local pulp and paper industry, for which hydrogen peroxide is a key element. The acquisition of the Canadian hydrogen peroxide plant from PeroxyChem offers United Initiators (UI) the opportunity to position itself optimally in the growing hydrogen peroxide market in the northwest of North America and to benefit from further attractive downstream applications of hydrogen peroxide.

The company, with its plant based in Prince George, has an excellent market presence in Canada and until recently was part of the chemical specialist PeroxyChem LLC, a producer of innovative high-end products in the field of peroxides and related chemicals. In February 2020, the Equistone portfolio company United Initiators acquired a majority stake in the PeroxyChem plant.

United Initiators, since 2016 part of the Equistone portfolio, produces a wide range of organic peroxides, persulfates and specialty chemicals. The global initiator specialist’s products are used by the industrial sector, for example in plastics manufacturing and processing, as well as in chemical synthesis. The acquisition of the hydrogen peroxide plant of PeroxyChem is an important step for United Initiators in its strategy to strengthen its third initiator group. As such, the transaction is in line with UI’s acquisition of a hydrogen peroxide plant in Turkey last year.

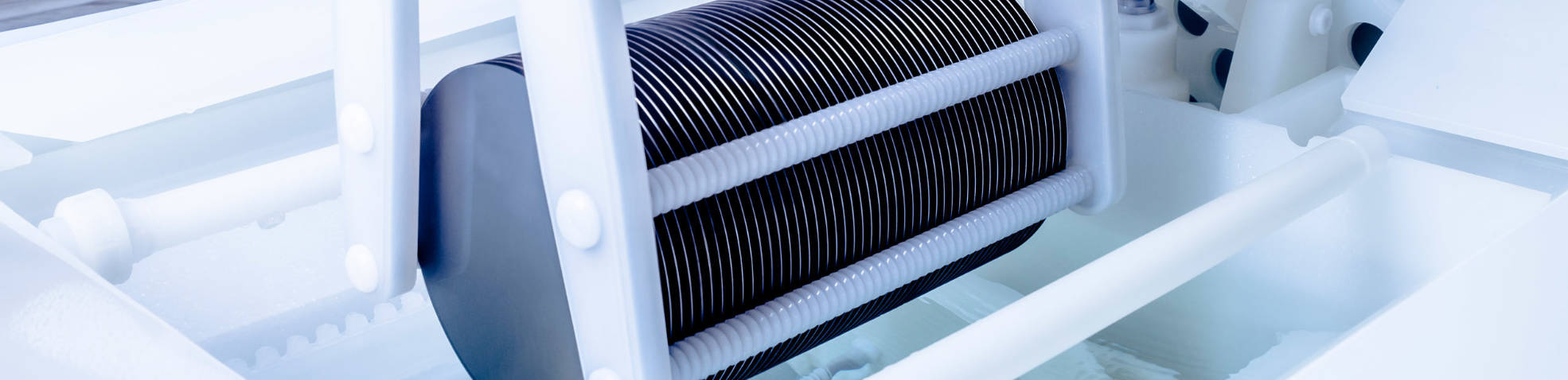

Reinraum-Equipment, Nasschemie and Automation (cleanroom equipment, wet chemistry and automation) – together these terms make up the acronym RENA, the name of a global technology pioneer from Gütenbach. Here in the head office in the Northern Black Forest region of Germany, and in another six sites worldwide as well, high-end equipment for wet chemical surface treatment is produced, for use primarily in the booming semiconductor, renewable energy, special glass and medical technology sectors. Equistone acquired a majority stake in the group in March 2019 and has since focused on the implementation of an expansion strategy: With over 1,000 employees, RENA continues to grow and is well-positioned to consolidate its strong market position. 2019 marked the most successful business year in the company’s recent history.

In the last year, RENA Technologies has created 100 additional jobs in the domestic market and recently started a 2,000 m2 extension in Gütenbach – a reaction to a very positive business development, with 2019 once again seeing a significant increase in turnover. Founded in 1993, the company has a wide customer portfolio within technologically sophisticated sectors and is seeing high demand across all its product groups. Whether renewable energies, medical and semiconductor technology or machines for the glass industry, RENA is seeing equally strong expansion in all areas and its pipeline is promising. A new diversification strategy that has replaced the previous one-sided focus on the solar industry is paying off. RENA also has a strong management team, employees with strong technology and engineering skills and a significant focus on research and development. An R&D and engineering team of over 100 experts and more than 150 patents are evidence of RENA’s ability to innovate and set new standards in the market. These factors all played an important role in Equistone’s decision to acquire RENA: "We are impressed by RENA’s market position, which is based most notably on innovative technology, a high level of quality, longstanding customer relationships and a strong management team," said Equistone Managing Director Stefan Maser at the time of the acquisition. David Zahnd, Investment Director at Equistone, added: "Together with RENA’s management team and staff we intend to continue developing the company’s growth trajectory, promote research and development and expand into new markets and regions."

Expansion into the US semiconductor market

Only six months after the acquisition of RENA by Equistone the first milestone was achieved: the acquisition and integration of MEI LLC, a wet processing equipment and service company for the semiconductor industry, based in Albany, Oregon. Both companies can now combine their strengths in high-end semiconductor technology and systematically cooperate through the use of synergies to develop their position in the US market. With their complementary product portfolios and regional focuses, RENA and MEI are in an excellent position to become a global player in the international semiconductor market.

Large-scale orders secured in several segments

Manual wet processing systems for R&D and the production of small and very small batches of microchips, as well as automatic wet processing systems, in which chip and MEMS manufacturers ensure a continuous batch production with process guarantees, are an important cornerstone of RENA’s portfolio. With significant mega-trends such as the increasing electrification of vehicles, artificial intelligence and the Internet of Things, there is great potential for additional growth here.

The development of high-performance production solutions for the surface processing and cleaning of dental implants, medical devices and optical substrates is another notable growth area. Since the beginning of the industrial mass production of solar cells, RENA has also provided production facilities and processing solutions for the wet chemical processing of solar cells – a highly sought-after field of activity in light of climate change and the transition towards sustainable forms of energy. Recently, RENA secured three significant large-scale orders with renowned Asian PERC solar cell manufacturers with an order volume in the double-digit millions range. The diversified high-tech company also provides ambitious solutions for glass, such as single-side inline processing and future-proof cleaning products, as well as etching for combined laser and wet processing technologies.

Peter Schneidewind, RENA’s CEO, comments on the partnership: "We are delighted to have Equistone as a reliable and financially strong partner to support our future growth. Together with our customers we will continue to develop individual applications and generate new intelligent solutions for wet chemical surface treatments worldwide."

Ever since 1913, our portfolio company Eschenbach Optik has stood for innovation. Since its founding, it has been setting new standards in the market for eyewear and optical products through new, unique developments in design, materials and technology. Its increase in market share in all key markets, coupled with the increase in sales figures, made 2019 an especially successful year for Eschenbach. The Nuremberg-based company has been at the cutting edge in optics for some time and the latest figures from Gesellschaft für Konsumforschung (GfK), the largest German market research institute, show that since September 2019 Eschenbach has for the first time sold the most frames of any eyewear brand in Germany, across all price segments.

Key to its success is the combination of design and functionality, with Eschenbach’s products being a leading example of “form follows function” within the eyewear industry. Eschenbach has already won several awards for its products – most recently the coveted "Red Dot" design award for the two full rim metal models "Brendel 902311 21" and "TITANFLEX 820826 50" in red and gold.

Established in 1955, the "Red Dot" award is one of the most coveted international quality seals for outstanding design. From interior and urban design to watches and glasses, the award recognises the best in design and business and counts design classics and style icons from these categories among its winners.

As well as the Red Dot award, which Eschenbach already received in both 2017 and 2018 for three models, the Nuremberg-based eyewear specialist has also won nine German Design Awards this year. These awards honour the manufacturers and designers of innovative products and projects as pioneers in the international design landscape. By winning these accolades, Eschenbach has written yet another chapter in its design success story in 2020.

You can find more information about Eschenbach’s Red Dot 2020 prize-winners here:

Brendel 902311 21 https://www.eschenbach-eyewear.com/en/product/brendel-eyewear-902311.html

TITANFLEX 820826 50 https://www.eschenbach-eyewear.com/en/product/titanflex-820826.html

Michael Bork, Senior Partner and Managing Director at Equistone Partners Europe, has, after much deliberation, decided for personal reasons to gradually step back from his duties and roles at Equistone. In January 2020, he resigned his position on the Management Board and on other committees in the group. Michael will remain Managing Director at Equistone until the end of December 2021 and during this time he will concentrate on supporting the portfolio companies for which he is responsible.

Stefan Maser, who joined Equistone in 2000, was appointed as new Managing Director for Germany in March 2020. For the previous eight years he was a Partner in our Munich office and was jointly responsible for the company’s private equity business in German-speaking countries.

"Two decades with Equistone – a long time and, thanks to interesting projects and an amazing team, I’ve enjoyed every minute. I’m looking forward to the new challenge and to the next ten years," says Stefan.

Another new appointment to Equistone’s team of Managing Directors for Germany is Alexis Milkovic, who joined it in March 2020. He has already been in our Munich office for twelve years, nine of them as a Partner with responsibility for many private equity transactions in German-speaking Europe.

Alexis says: "Every day at Equistone is focused on the future, both for our portfolio companies and for our own development. Our fantastic team is always thinking of the next step and I’m delighted to be part of it."

Stephan Köhler, CFO and Investor Relations for Germany, Switzerland and the Netherlands, is taking over from Michael H. Bork on Equistone’s European Management Board. Being with Equistone for twelve years, nine of them as Partner, he will continue to act as a link between the team in Munich and other European offices in this additional role as a European Management Board member as well.

A key part of our business is to set ambitious goals and to work together tirelessly to achieve them. The journey is paved with milestones and these should be celebrated. The same applies to our team: Being an important part of the company for many years is a welcome occasion to appreciate both past and future cooperation with colleagues. Those celebrating anniversaries this year are Stefan Maser, who has been with the company for 20 years and was recently appointed Managing Director, as well as Manuela Kiefner, Executive Assistant in the Munich office, and David Zahnd, Investment Director in Zurich, both of whom have spent five exciting and successful years at Equistone.

"Equistone’s success would not be possible without our employees. As well as professional expertise, their mutual respect, trust and a special team spirit are all key elements that make up the Equistone culture," says Dirk Schekerka, Senior Partner and Country Head for Equistone Germany. "I congratulate those celebrating anniversaries and thank them for their hard work and commitment."