Your

The current situation is undoubtedly challenging and demanding. Being a strong, experienced and reliable partner for portfolio companies has never been more important than in the current environment.

Despite the current challenges Equistone Partners Europe Fund VI can look back on a hugely successful investment period. In the last three and a half years, the Fund has made ten investments in the DACH/NL region, and the establishment of our Amsterdam office has strengthened our geographical presence in the thriving Benelux region.

We are thus well placed to continue our mission of successfully deploying capital in fast-growing, technology-enabled companies whilst applying our Equistone philosophy. In recent years, ESG has become a key pillar of our value-creation strategy, so we have strengthened our team with a dedicated colleague to further support us in accelerating the roll-out of our ESG toolkit.

This edition of our Equistone newsletter provides our latest news regarding investments and changes to our team.

Your

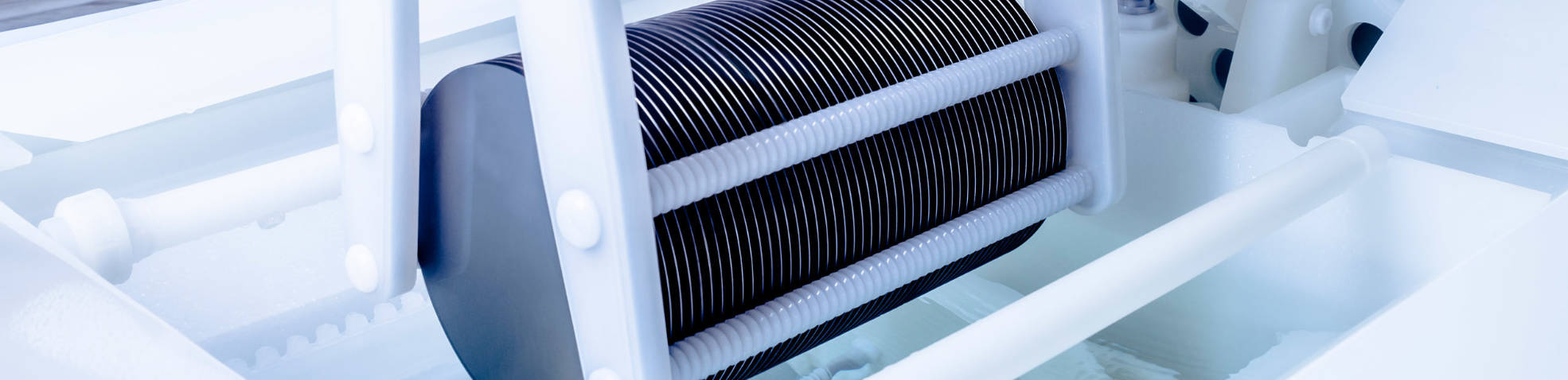

SF Filter AG is a leading independent European distribution platform for mobile and industrial filters. The filter specialist sells to more than 60 countries primarily servicing end users and resellers with its products and know-how. With its extensive product portfolio of filters for air, fuels, hydraulics, oil, pneumatics and fluids, SF Filter has established itself as a key ‘one-stop shop’ for its customers. This acquisition adds an established player in the fragmented consumer market for filtration to the Equistone portfolio family. We intend to work closely together with management to continue driving SF Filter’s further growth both in Switzerland and in Europe organically and through add-on acquisitions.

RENA Technologies, a German specialist for the manufacturing of equipment for wet-chemical surface treatment, has sold its China solar business to Productive Technologies Company, which is listed on the Hong Kong Stock Exchange. After acquiring a majority stake in RENA in March 2019, Equistone supported the management team in implementing a successful strategy expansion into new market segments, including by taking over the Austrian company HES (now RENA Austria) and US-based MEI (now RENA North America). Due to its strong growth in other business segments like semiconductor, wafering, glass and medtech, the importance of the China solar business for RENA has continuously decreased in recent years. However, RENA remains active for its customers in China in the other business segments.

Our Dutch portfolio companies have been busy as well: Heras, a supplier of mobile and permanent perimeter protection systems, products and services, recently welcomed their new CEO: Emmanuel Rigaux, who comes with many years of experience in managing international business in the building materials industry, took over from Gilles Rabot in June who led the firm for seven years. Despite this handover the overall objective remains unchanged: To further expand Heras’ position as the leading premium brand in the perimeter protection space and to continue the company’s transformation towards an integrated solutions provider.

Our Kusters Beheer investment – a leading manufacturer of high-tech precision components that was founded by the Kusters family in 1973 – is now called Andra Tech Group with immediate effect. The group, which consists of five high-precision specialists, has therefore been given a common umbrella name that is also intended to represent its broader focus and its philosophy: #Technology by and for #People. The two directors explain more about the history behind this name in our Platform+ Magazine.

Cologne digitisation expert TIMETOACT GROUP made its second and third acquisition within just one year of the beginning of our partnership in June 2021 (read more in the current edition of Platform+ Magazine): The Atlassian Platinum Solution Partner catworkx has been a part of the fast-growing tech group since April. catworkx supports the entire Atlassian product range and offers process consulting and implementation, app development, platform solutions and product installations in the large-scale enterprise sector. Together with TIMETOACT, the growth alliance will see the further expansion of catworkx’ market position and the establishment of a leading Atlassian Champion in the DACH region. In September, OpenAdvice IT Services GmbH, a proven specialist in application performance monitoring and business service assurance, became part of the group, too.

1. The Coronavirus pandemic, war in Ukraine and a rapidly deteriorating global energy crisis: The last number of months have placed heavy demands on the German economy, which has sometimes faced multiple crises at once. How have the challenges of recent months impacted the sourcing process for Equistone’s funds? Have you become more cautious?

There is no doubt that the combination of simultaneous crises has altered our perspective as a fund advisor on various industrial sectors. At the same time though, the challenges that we have faced – and those we continue to face – have underscored the critical importance of assessing business models very carefully, particularly when it comes to the question of resilience during times of crisis. How can the company respond to further lockdowns? How successfully can it pass on price increases to customers? What happens if the gas taps really are turned off? When I’m asked whether investors have generally become more cautious, I would have to say yes overall. Nevertheless, as in almost any crisis the situation is also opening up new opportunities. For instance, it is accelerating the growth of companies that are helping to drive the energy transition. Irrespective of the unusual economic and societal situation that we currently find ourselves in, Equistone funds continue to look for attractive and crisis-resilient investment opportunities.

2. With over 170 transactions, more than 50 of which are in the DACH/NL region, Equistone is one of Europe’s most active and successful investment houses. But how do you find the “perfect” deal? And what role do the people behind the company play in this sort of process? How important is the chemistry between them?

There is probably no such thing as a “silver bullet” that allows the “perfect deal” to be sourced – the approach varies not only from company to company, but even from one person to another. And that’s a good thing. For example, one person might depend on a wide network to learn about new trends at an early stage, while the next might conduct painstaking work in submarkets to develop hypotheses. There are many ways to identify exciting and interesting deals, but the only common denominator is probably perseverance. Proprietary situations require time and commitment. Since the buyout market is heavily contested and attractive investment opportunities are rare, sellers must be persuaded through quality and competence. Personalities are also needed here as well. The human factor is essential in the deal-sourcing process and plays a central role at Equistone. Equistone funds would not invest in a company that does not have impressive people behind it. Since Equistone considers itself to be a partner to management teams, a certain chemistry is also vital.

3. What are the top three reasons for you personally that make a company interesting from an investor’s point of view?

The phrase “cash is king” comes pretty high on the list, particularly in turbulent times. In other words, a flexible P&L that allows a company to earn money even when macroeconomic circumstances are weak, thereby servicing its liabilities while nevertheless continuing to invest. I also consider agility to be highly attractive, whether it’s in pricing, in the product mix, in the supply chain or in production. How quickly can a company respond to change during turbulent times? The third reason I would mention is the scalability of the business model. Only if the business model is scalable and offers certain economies of scale can internationalisation and buy-&-build lead to success.

Since our inception we have depended on experienced, strong personalities who can support the Equistone family with their success stories thanks to their personal commitment and their ability to innovate. We are delighted to announce the following new addition and anniversary in our Munich office:

Our Munich team continues to grow

Since September 2022, Sophia Nicol has strengthened our Munich team as a new ESG manager. With her extensive experience in the field of sustainability strategy and management, as well as in non-financial reporting, she will play a key role in developing our sustainability strategy in the DACH/NL region and support our portfolio companies with ESG-related questions and projects.

Anniversary at Equistone

From Associate to Investment Director: For five years now, Moritz Treude is part of our Team in the Munich office, actively supporting the portfolio companies in executing lasting growth strategies. Besides his focus on transactions and portfolio management, in particular in the Industrials sector, Moritz has assumed a key role in developing and driving our ESG strategy in recent years.

Things are also moving in our international Equistone family: This includes the majority stake in Virgin Experience Days, a leading provider of experience gifts – such as parachute jumps or exclusive dinners – for customers in the UK and the USA, the investment in the French company Safic-Alcan, one of the world’s leading distributors of speciality chemicals, the stake in the Out-of-Home (OOH) advertising agency Talon Outdoor, and the exit of digital maritime navigation provider OneOcean.